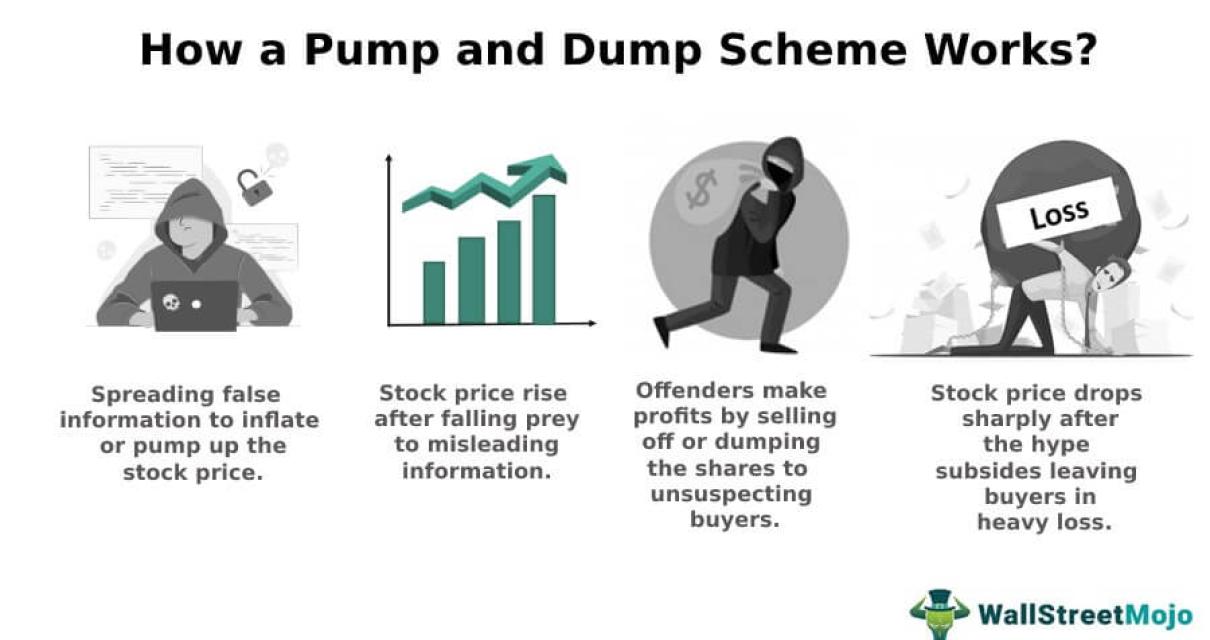

How crypto pump and dumps work

Crypto pump and dumps are a form of fraud in which individuals or groups attempt to drive up the price of a cryptocurrency by selling large amounts of the currency, often with the intent of buying it back at a higher price later.

How to profit from crypto pump and dumps

Some people believe that crypto pump and dumps are a way to make money. However, this is not always the case.

In a crypto pump and dump, traders sell their coins at an artificially high price and then buy them back at a lower price. This often happens in a short period of time and can cause the price of a cryptocurrency to rise quickly.

However, this approach is not always successful. In fact, it is often risky and can lead to losses.

Therefore, it is important to be aware of the risks before participating in a crypto pump and dump.

How to spot a crypto pump and dump

There are a few key things to look out for when spotting a crypto pump and dump.

Firstly, be suspicious of any sudden and dramatic increases in prices. This could indicate that someone is trying to artificially boost prices and then sell off their holdings, potentially leaving other investors with losses.

Secondly, always take care when investing in cryptocurrencies – just as with any other investment, there is the potential for big financial losses if you don’t know what you’re doing. Never invest money you cannot afford to lose.

Finally, be aware of any suspicious behaviour on social media or online forums related to cryptocurrencies. This could include people promoting or selling cryptocurrencies in an overly exuberant or misleading way, or making false claims about the value of particular cryptocurrencies. If you see any of this happening, please report it to your local police or financial regulator.

How to avoid getting caught in a crypto pump and dump

There is no guaranteed way to avoid getting caught in a crypto pump and dump, but following some basic tips can help minimize your chances.

Do your research: Before investing in any new cryptocurrency, be sure to do your own research and understand the risks involved. Don’t fall victim to hype and don’t invest more than you can afford to lose.

Don’t invest more than you can afford to lose: Remember that cryptocurrencies are highly volatile and can quickly become worth much more or much less than the original investment. If you can’t afford to lose all of your money, avoid investing altogether.

Never invest money you cannot afford to lose: Never invest money you cannot afford to lose, no matter how tempting it may be. If an investment sounds too good to be true, it probably is.

Stay informed: Stay up to date on all of the latest news and developments related to cryptocurrencies and blockchain technology. This will help you make more informed decisions about whether or not to invest.

Never invest money you cannot afford to lose, no matter how tempting it may be.

What to do if you spot a crypto pump and dump

If you spot a crypto pump and dump, it's important to stay vigilant. Pump and dumps are illegal in most jurisdictions, and can result in serious financial losses. If you think you've spotted a pump and dump, don't hesitate to report it to authorities.

How to prevent a crypto pump and dump

Cryptocurrencies are volatile and can rise and fall in price quickly. It is important to do your homework before investing in any cryptocurrency, and to be aware of potential pump and dumps.

Here are some tips to help you prevent a crypto pump and dump:

1. Do your research: Before investing in a cryptocurrency, be sure to do your research. learn about the coin, the blockchain, and the technology behind it.

2. Do not invest more than you can afford to lose: Be careful not to invest more money than you can afford to lose. Pump and dumps can happen quickly and easily, and if you invest too much, you could lose all of your investment.

3. Be cautious of celebrity endorsements: Some celebrities have endorsed cryptocurrencies, which can increase their popularity and value. However, be cautious of celebrity endorsements – they may not be reliable sources of information.

4. Be aware of scams: Be aware of scams – especially if you are not familiar with cryptocurrencies. There have been a number of scams involving cryptocurrencies in recent years, and be sure to do your research before investing.

5. Guard your coins: Always keep your coins safe – especially if you are not familiar with cryptocurrencies. Do not leave your coins on an exchange – use a hardware wallet or keep them in a cold storage wallet.